Introduction

Imagine trading the rise and fall of global assets without owning a single one of them. Sounds like a superpower, right? Welcome to the world of CFD Instruments – a modern way of trading where flexibility, opportunity, and strategy collide. Whether you’re a day trader watching charts tick by the second or a casual market explorer, understanding CFD instruments can open doors to markets you’ve only heard about in headlines.

CFD Instruments

A CFD, or Contract for Difference, is a type of deal traders make with their brokers. In this deal, both agree to pay each other the price difference of an asset from the time the trade starts to the time it ends. If you predict the price will rise and it does, you earn the difference as a profit. If prices drop instead, you cover the gap as a loss. CFDs stand out because they don’t require you to own the asset you’re betting on. For example, trading a CFD on gold doesn’t mean you’re keeping gold in some vault. You’re just speculating whether the price will increase or decrease. It offers traders a way to reach different markets while avoiding the responsibilities of owning things outright.

How Do CFD Instruments Work?

Trading CFDs focuses on changes in price instead of owning the actual asset. Here’s the process: you pick an asset like gold, Apple shares, the EUR/USD pair, or even Bitcoin. Next, you choose whether you think the price will increase to go long or decrease to go short. If your guess turns out correct, you profit from the price difference. If it’s wrong, you lose money. A major feature of CFD trading is leverage. It gives traders the ability to manage larger positions using less money. For instance, a $1,000 investment could let you handle a $20,000 CFD position, depending on the leverage your broker offers. That’s strong yet carries risks. We’ll talk more about the risks involved in trading CFDs later in this blog.

No actual gold is bought or sold. You’re trading price movement, not ownership.

Main Characteristics of CFDs:

CFDs are different due to a few distinct aspects:

- Leverage and Margin Trading: You need a small deposit to take control of larger trades. This makes it possible to trade even with a small amount of money.

- Access to Global Markets: One account lets you trade in multiple markets, like stocks or cryptocurrencies.

- No Need for Ownership: You don’t have to own physical assets like gold or oil. You just bet on how their prices will move.

- Trade Long or Short: Traditional investing relies on rising prices to make money. CFDs let you make money even when prices drop.

- Trading Almost Anytime: Many CFD tools, including forex and crypto, allow you to trade online all the time during the week.

Why Traders Are Turning to CFDs

Traders love CFDs for three reasons:

- Flexibility: You can go long or short, profit in both rising and falling markets.

- Leverage: Small capital, big positions. (But beware, leverage is a double-edged sword.)

- Diverse Markets: Trade global assets without switching platforms or currencies.

Key Types of CFD Instruments

Let’s break down the major categories:

- Forex CFDs: Trade currency pairs like EUR/USD, GBP/JPY.

- Stock CFDs: Access shares of companies like Tesla, Amazon, Meta.

- Commodity CFDs: Think oil, gold, silver, wheat.

- Index CFDs: Bet on major indices like S&P 500, FTSE 100.

- Crypto CFDs: Trade BTC, ETH, and altcoins without owning digital wallets.

Each type brings its own personality – forex is fast-paced, stocks are news-driven, and commodities are often event-sensitive.

The Mechanics: Margin, Leverage, and Spread

Trading CFDs isn’t just about clicking “Buy” or “Sell.”

- Margin: This is your security deposit. It’s a small portion of the full trade value.

- Leverage: Allows you to control a large position with a small amount of money. For example, with 1:100 leverage, $100 controls $10,000.

- Spread: The difference between the buy and sell price. This is where brokers often make money.

Remember, leverage amplifies both profits and losses like turning up the volume on both the wins and the losses.

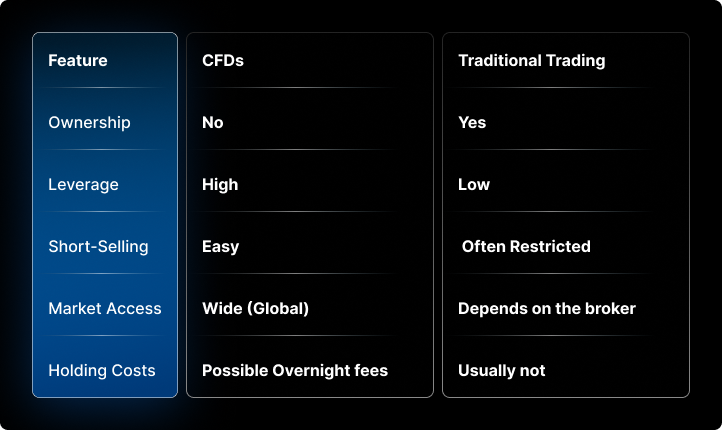

CFD vs Traditional Trading: What’s the Catch?

Let’s simplify it:

Risks Involved in CFD Trading

Trading CFDs can be thrilling, but it’s not for the faint-hearted. Here’s why:

- Leverage Risk: You can lose more than your initial investment.

- Market Volatility: Sudden price swings can trigger stop-outs.

- Counterparty Risk: You’re depending on your broker’s solvency.

- Overtrading Temptation: Fast markets can lead to emotional decisions.

So, before you dive in, ask yourself – can I handle the emotional side of losing money too?

The Psychology Behind Trading CFDs

Most losses in CFD trading don’t come from bad strategies; they come from bad decisions.

Fear, greed, revenge trading, FOMO, these are real psychological traps. If you’re trading emotionally, you’re playing with fire.

Great CFD traders are a mix of analyst and monk, calm, calculating, and always focused on risk.

Choosing the Right CFD Instrument

All CFD instruments are not made equal. Your choice should depend on:

- Market familiarity

- Volatility tolerance

- Available capital

- Time commitment

Fundamental vs Technical Approach

When analyzing CFD instruments, you’ll hear two schools of thought:

- Fundamental Analysis: Based on news, earnings, and central bank policy.

- Technical Analysis: Based on charts, patterns, and indicators.

Most traders use a blend of both. But here’s a golden rule: know your why before you enter a trade.

Best Markets for CFD Trading

CFDs allow access to global markets. Some of the most popular are:

- Forex Market: Highly liquid, open 24/5.

- US Equities: Transparent and news-driven.

- Commodities like Oil & Gold: Volatile, good for short-term trades.

- Indices: Easier to analyze than individual stocks.

Your ideal market depends on your time zone, trading style, and risk appetite.

How to Build a CFD Trading Strategy

Your CFD journey should be guided by a plan:

- Define Goals: Are you in for growth, income, or learning?

- Pick Instruments: Choose a few to specialize in.

- Set Entry/Exit Rules: Based on indicators, price levels, or fundamentals.

- Risk Management: Stop-losses, position sizing, and maximum drawdown limits.

- Review and Reflect: Keep a journal, track mistakes, repeat what works.

Are CFD Instruments Right for You?

Ask yourself:

- Do I understand the risk?

- Can I handle leveraged losses?

- Am I willing to learn and adapt?

CFD instruments are tools – powerful, flexible, and potentially profitable. But like any tool, they must be used with skill and respect.

Conclusion

CFD instruments have changed the trading game. They allow you to explore global markets, trade with leverage, and seize opportunities that were once out of reach for everyday traders.

But it’s not a shortcut to riches. It’s a vehicle for the informed, disciplined, and prepared. Whether you’re looking to sharpen your skills or diversify your strategy, understanding how CFD instruments work could be the key to your next breakthrough.