If there’s one currency pair every trader eventually comes across, it’s EUR/USD. It’s the world’s most traded pair – liquid, fast-moving, and always influenced by something happening in the global economy. Whether you’re taking your very first steps in forex or you’ve been around long enough to see a few market cycles, understanding how to trade EUR/USD can completely change the way you look at the charts.

In this guide, I’ll walk you through everything that actually matters when trading the pair – not the overcomplicated theories, but the practical insights that real traders rely on. You’ll learn what moves EUR/USD, how to read its behavior, and what strategies tend to work best depending on your experience and trading style.

Why EUR/USD Holds So Much Weight in the Market

Out of all currency pairs, EUR/USD consistently sits at the top in daily trading volume. And there’s a reason for that. The euro and the U.S. dollar represent two huge economic regions, both of which release steady streams of data and policy decisions that traders watch closely. Because of this constant flow of information, EUR/USD tends to behave in a predictable, orderly way compared to many exotic or low-volume pairs.

This is also why spreads remain tight and execution stays smooth – conditions that every trader, beginner or experienced, appreciates.

Getting to Know the Two Sides: EUR and USD

To trade EUR/USD well, you need a feel for what drives each currency.

The euro reacts strongly to decisions made by the European Central Bank, changes in inflation across Europe, and the general health of major economies like Germany or France.

The U.S. dollar, meanwhile, is heavily influenced by the Federal Reserve, employment numbers like NFP, and overall global risk sentiment – because investors still see the dollar as a safe haven during uncertain times.

Once you start connecting price movements to these stories, the charts begin to make much more sense.

How the EUR/USD Exchange Rate Moves

The price you see – for example, 1.1000 – simply shows how many U.S. dollars one euro is worth. If EUR/USD goes up, it means the euro strengthened or the dollar weakened. If it falls, the opposite happens.

Small changes matter more than most beginners expect. A move from 1.1000 to 1.1010 may look tiny, but with leverage, it can translate into a significant profit or loss. That’s why understanding the pair’s behavior, volatility, and timing is so important.

What Really Moves EUR/USD Day to Day

Although the chart can seem unpredictable at times, EUR/USD usually reacts to a handful of recurring influences:

- Interest rate expectations from the Fed and ECB

• Inflation numbers like CPI

• Major economic data releases – especially U.S. NFP

• Political or geopolitical news

• Market sentiment toward risk

Most big moves in the pair can be traced back to one of these factors. The more familiar you become with them, the more confident you’ll feel reading price action in real time.

The Importance of Liquidity in the EUR/USD Market

Liquidity is one of the biggest advantages of trading EUR/USD. In simple terms, liquidity means how easily you can buy or sell a currency without affecting its price too much. And since this pair is the most traded in the world, it’s about as liquid as the market gets.

That liquidity has a few major benefits: tighter spreads, less slippage, and smoother order execution. For active traders, these small details make all the difference.

Imagine you’re scalping – entering and exiting trades within minutes. You need to get in and out fast without paying a huge cost in spreads or delays. That’s where EUR/USD shines. Even during volatile hours, you’ll almost always find enough buyers and sellers to match your orders instantly.

But liquidity also comes with its own rhythm. The pair tends to move most during the London and New York sessions, when trading desks from both sides of the Atlantic overlap. Outside those hours, things quiet down, and that’s often when impatient traders get caught forcing trades.

Smart traders learn to respect that rhythm. They trade when the market is alive and step back when it’s asleep.

Understanding Volatility in EUR/USD

Volatility is the ‘personality’ of the currency pair – it tells us how crazy it moves. Even though EUR/USD is viewed as relatively stable, it certainly has its moments of wild energy.

In general, the pair will be more active during market-moving headlines: Non-Farm Payrolls, CPI releases, Federal Reserve or ECB meetings, for example. You can almost feel the anticipation when a trader’s news feed is about to report. Within seconds, spreads are unusually wide, prices explode, and liquidity thins out.

Indeed, some traders love this chaos, loving the thrill of trading news tand rading events. Other traders want to avoid the chaos at all costs – they like their price action smooth and predictable! It’s important to know who you are.

If you are just beginning to learn how to trade EUR/USD, it’s best to begin in calmer market conditions. After a trader gains experience and learns how to play the report, then the trader can slowly begin to trade in more volatile conditions.

Best Market Hours to Trade EUR/USD

Having good timing makes all the difference between success and frustration. The EUR/USD currency pair follows the global forex clock, meaning that it is open 24 hours a day, five days a week. However, not all hours are the same.

Typically, the EUR/USD currency pair will be most active in the London session (8 AM to 4 PM GMT) and the New York session (1 PM to 9 PM GMT). The biggest moves and cleanest trends typically appear in the overlap of these two sessions. Trading setups are generally cleaner during these times, as well.

During the Asian session, activity slows down. The moves are smaller, and spreads can widen slightly. If you’re a beginner, it’s often best to stick with the London and New York hours, when the market truly breathes.

Think of it this way – trading during active hours is like surfing when the waves are high. You get more opportunities to ride momentum, rather than paddling endlessly in flat water.

How to Read EUR/USD Charts

Charts tell stories, and once you learn to read them, those stories become opportunities.

The first step is understanding the basics:

- Candlesticks show price movement within a time frame.

- Support and resistance levels mark zones where the market has previously reversed.

- Trends reveal the dominant direction of price.

When you look at a EUR/USD chart, try not to get lost in indicators right away. Start by identifying structure – higher highs and higher lows in an uptrend, lower highs and lower lows in a downtrend.

A simple, clean chart often reveals more truth than a screen full of colorful tools. As you gain experience, you can layer in moving averages, RSI, or Fibonacci retracements – but remember, those are just tools. The real skill lies in reading the language of price itself.

Pips, Lots, and Leverage Explained

Forex has its own vocabulary, and before you trade EUR/USD, you need to speak it fluently.

A pip (short for “percentage in point”) is the smallest unit of price change – usually 0.0001 for EUR/USD. So, if the pair moves from 1.1000 to 1.1010, that’s a 10-pip move.

A lot is the size of your trade.

- 1 standard lot = 100,000 units

- 1 mini lot = 10,000 units

- 1 micro lot = 1,000 units

Then there’s leverage – the double-edged sword of forex trading. It allows you to control a larger position with a smaller amount of capital. For example, with 1:100 leverage, you can control $100,000 with just $1,000.

Leverage amplifies both gains and losses. Used wisely, it’s a powerful tool. Used recklessly, it’s a quick route to blowing your account. The best traders treat leverage with respect, like handling electricity – useful, but dangerous if you’re careless.

Setting Up Your Trading Account

Before you can begin trading, you will be required to open a forex trading account. Doing so is mostly a straightforward process, but the decisions you make in the beginning will affect your trading experience. Choose a regulated Forex broker that has tight spreads and a reliable platform (like MetaTrader 4/5 or cTrader).

Once you have confirmed your account, you want to deposit an amount of money you are comfortable risking. Again, never start with money you cannot afford to lose. From there, you will want to set up your trading environment, which would entail setting up all of your charts, watchlists, and alerts.

Keep things simple. You don’t need ten indicators or multiple monitors to start. What you need is clarity and focus.

Finally, begin on a demo account. Practice placing trades, setting stop-losses, and managing risk. When you feel consistent, then switch to a live account – slowly and with discipline.

Choosing the Right Broker for EUR/USD

Not all brokers are created equal. Since EUR/USD is the most traded pair, most brokers offer excellent conditions for it – but that doesn’t mean you should pick the first one you find.

Look for these key factors:

- Regulation and trustworthiness (FCA, ASIC, CySEC, etc.)

- Low spreads and commissions

- Fast withdrawals and deposits

- Responsive customer support

Read user reviews, test their platform, and check execution speed during volatile events. If a broker freezes or re-quotes your orders during NFP, that’s a red flag.

A good broker feels invisible – they simply let you focus on trading, not on worrying whether your trade went through.

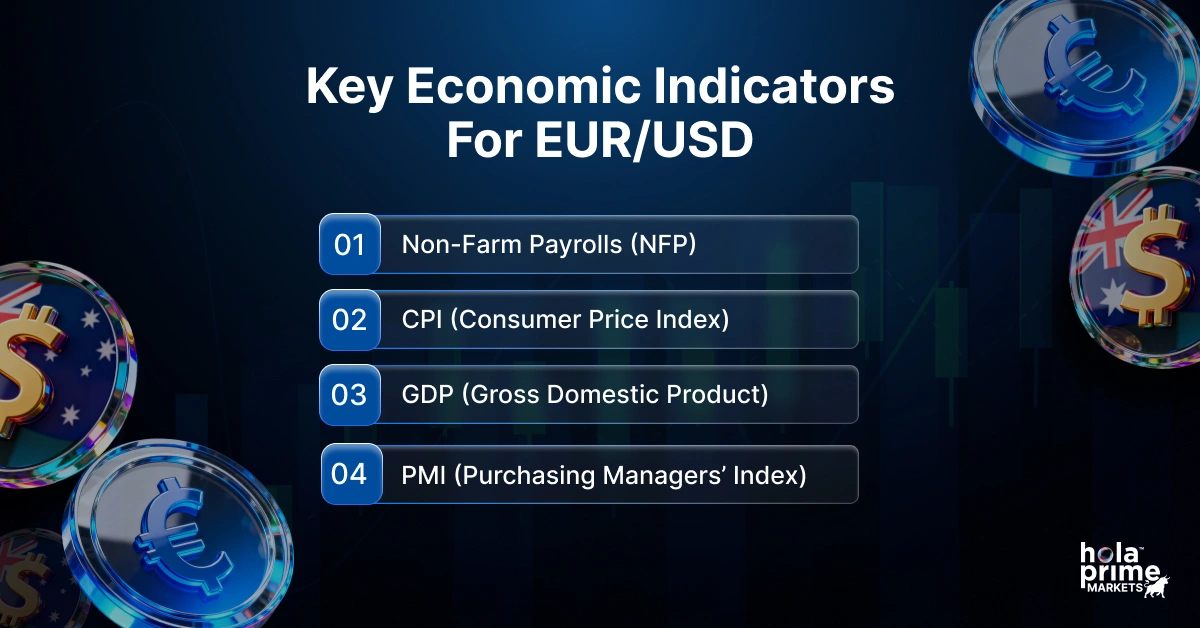

The Role of Economic Indicators

Trading EUR/USD without understanding economic indicators is like sailing without a compass.

Each month, key reports move the pair dramatically:

- Non-Farm Payrolls (NFP) — measures U.S. job creation and signals Fed policy direction.

- CPI (Consumer Price Index) — reveals inflation trends.

- GDP (Gross Domestic Product) — shows economic health for both regions.

- PMI (Purchasing Managers’ Index) — indicates business confidence.

The secret isn’t memorizing every indicator – it’s learning how the market feels about them. Sometimes, good news for one side isn’t enough if traders are already expecting better. Sentiment always adds an extra layer to the logic.

How Interest Rates Affect EUR/USD

Interest rates are the heartbeat of currency markets. The higher the rate, the more attractive the currency.

When the Federal Reserve raises rates, investors flock to the U.S. dollar, often pushing EUR/USD down. When the European Central Bank hikes rates, the euro tends to strengthen instead.

But it’s not just about the numbers – it’s about expectations. Traders are constantly trying to stay one step ahead, pricing in potential moves long before they happen. That’s why sometimes you’ll see EUR/USD rise even after a rate hike if the market believes it was the last one for a while.

Understanding this dance between actual policy and expectations can give you a major edge as a trader.

The Role of the Federal Reserve (Fed)

The Federal Reserve is arguably the most influential central bank in the world. Its policies ripple across global markets and EUR/USD feels those ripples instantly.

The Fed’s main tools include interest rates and quantitative easing or tightening. When they raise rates, they make the dollar stronger. When they cut rates or print money, they weaken it.

But it’s not just about what the Fed does – it’s about what it says. Every Fed statement, every press conference, every subtle change in language is analyzed by traders looking for hints about future policy.

If you want to trade EUR/USD professionally, start following the Fed. Learn how they think, read their meeting minutes, and pay attention to inflation and employment data – that’s the foundation of their decisions.

The Role of the European Central Bank (ECB)

If the Federal Reserve is the loudest voice in the room, the European Central Bank is the one that chooses its words very carefully. What the ECB does or even hints at – can move the EUR/USD pair in seconds.

The ECB’s main job is to keep inflation in check and maintain price stability across the eurozone. But because the euro covers so many economies – Germany, France, Italy, Spain, and more – balancing their needs is like juggling glass balls. A rate hike that’s good for one country might hurt another.

When the ECB raises interest rates, it usually pushes the euro higher against the dollar. But markets are emotional. Sometimes the hike is already “priced in.” Other times, it’s the tone of the speech afterward that causes the real move.

If you trade EUR/USD, it helps to listen not just to what the ECB says, but how they say it. Their wording – phrases like “persistent inflationary pressures” or “further tightening may be warranted” – often tell you more than the numbers.

Geopolitical Events and Their Impact on EUR/USD

Currencies are not just numbers on a screen; they’re reflections of real-world confidence. Every political headline, election result, or military event can cause waves in the EUR/USD pair.

For instance, when uncertainty rises in Europe – say, a surprise election outcome in Italy or an energy crisis affecting the EU – the euro tends to weaken. Investors move toward the safety of the U.S. dollar, which still acts as the world’s go-to safe haven.

On the other hand, when the global mood brightens and risk appetite grows, traders often shift money back into the euro. That’s why EUR/USD often rises in “risk-on” markets and falls in “risk-off” ones.

The trick isn’t predicting these events – that’s impossible. It’s staying adaptable. You learn to read sentiment, follow headlines, and manage risk so you’re never overexposed when the world suddenly tilts.

Using Technical Analysis in EUR/USD Trading

If fundamental factors are the “why,” technical analysis is the “when.” It helps traders find precise entry and exit points by studying chart patterns and price behavior.

Most EUR/USD traders rely on simple tools – moving averages, Fibonacci retracements, and trendlines. These reveal the structure of the market: where price has paused before, and where it might again.

But the real skill is in interpretation. A chart is like a heartbeat monitor. You can’t just stare at the lines – you need to understand what they’re saying about buyers and sellers.

When you see price consolidating tightly before breaking a key resistance, that’s not just a pattern – it’s a story of traders building pressure. Learning to read those stories is what separates a random entry from a smart one.

Fundamental Analysis for EUR/USD

Fundamental analysis digs into the economic health behind the numbers. For EUR/USD, that means watching two giants: the U.S. and the Eurozone.

Everything – GDP growth, inflation, unemployment, political stability – plays a part. For example, if the U.S. reports strong job growth and steady inflation, the dollar tends to strengthen because traders expect the Fed to tighten policy.

Meanwhile, weak manufacturing data or slow inflation in Europe can weigh on the euro. But fundamentals don’t move instantly; they build narratives that guide longer-term trends.

Think of fundamentals as the wind and technicals as your sails. The wind decides where the market wants to go, but the sails – your strategy – determine how you get there.

Sentiment Analysis and Why It Matters

Trading isn’t just logic – it’s emotion. Markets move because people move money, and people move money based on how they feel. That’s sentiment.

If traders believe the dollar is strong, they’ll buy it. If they believe the eurozone is struggling, they’ll sell. It often doesn’t even matter if the facts back it up – the belief itself drives price.

Sentiment analysis is about reading that mood. You can gauge it through tools like the Commitment of Traders (COT) report, social trading data, or even the tone of financial news.

The irony is, sentiment often overshoots reality. By the time everyone’s bullish, the top is near. By the time panic hits, the bottom isn’t far. The best EUR/USD traders don’t fight emotion – they use it.

The Best Timeframes for EUR/USD Trading

One of the first things you realize as a trader is that timeframes change everything. A pattern that looks like a clear breakout on the 15-minute chart might just be noise on the daily chart.

If you’re a scalper, you’ll live on the 1-minute and 5-minute charts, watching every tick. If you’re a day trader, the 15-minute to 1-hour range is your playground. Swing traders, on the other hand, zoom out – they look at 4-hour or daily charts, seeking broader trends.

The right timeframe isn’t about rules; it’s about personality. If you get anxious waiting days for a trade to unfold, you’re not a swing trader. If you get stressed staring at charts all day, you’re not a scalper.

The key is to find a rhythm that matches your patience and your lifestyle.

Scalping Strategies for EUR/USD

Scalping is fast, intense, and not for everyone. It’s about catching tiny moves – sometimes just 5 to 10 pips – dozens of times a day.

Because EUR/USD has low spreads and high liquidity, it’s perfect for scalping. You might use indicators like the 20-period EMA, Bollinger Bands, or short-term RSI to time entries. But what matters most is speed and discipline.

A scalper doesn’t hesitate. You get in, you get out, and you don’t overthink it. The biggest mistake new scalpers make is turning a small scalp into a swing trade when it goes wrong. That’s how accounts blow up.

The best scalpers treat it like a business – focused, consistent, and emotion-free.

Day Trading EUR/USD

Day trading is a middle ground between scalping and longer-term trading. You open and close all trades within the same day, aiming to catch a few strong moves.

The London and New York sessions are your best friends here. That’s when price action is clean, volatility is high, and news events create opportunity.

A simple but effective day trading plan might involve marking support and resistance zones from the previous day, waiting for price to approach them, and trading the bounce or breakout with clear risk management.

What separates good day traders from gamblers isn’t prediction – it’s patience. They wait for their setup like a hunter waits for the right shot.

Swing Trading EUR/USD

Swing trading is slower, more relaxed, and ideal for traders who can’t sit in front of screens all day. You hold trades for several days or even weeks, riding medium-term trends.

The key is identifying when momentum shifts. Maybe EUR/USD just broke a key level after consolidating for weeks – that’s a swing trader’s signal.

You’ll often rely on daily charts, moving averages, and trendlines. The hardest part isn’t finding trades – it’s holding them. When price pulls back, doubt creeps in. That’s where emotional control becomes your real edge.

Position Trading Strategies

Position trading is the long game. You’re not trying to catch every move – you’re trying to capture the direction of the market over weeks or even months.

This style depends heavily on fundamental analysis. You follow interest rate trends, economic cycles, and global events. You might use weekly or monthly charts to confirm the bigger picture.

It’s less stressful but requires conviction. You can’t panic at every 100-pip retracement. You have to trust your thesis – until the data proves otherwise.

The Best Strategy to Trade EUR/USD for Beginners

If you’re new to trading, simplicity is your best ally. Forget the complicated systems and fancy indicators. Start with structure and patience.

One of the easiest and most effective beginner strategies is support and resistance trading. Draw horizontal lines at areas where the price has previously bounced or reversed. When price returns to those zones, wait for confirmation – like a rejection candle or momentum shift, and trade in that direction.

Use small position sizes, set clear stop losses, and aim for realistic profits. The goal isn’t to win every trade – it’s to learn consistency and control. Once you master that, everything else becomes easier.

Price Action Trading in EUR/USD

Price action trading is one of those timeless approaches that doesn’t rely on fancy indicators or complex systems – it’s all about reading what the market itself is saying. When you trade EUR/USD using price action, you’re essentially interpreting the “language” of the market: how candles form, how they reject certain levels, and how they react around zones of interest.

A price action trader studies things like pin bars, engulfing candles, inside bars, and trendline breaks. For instance, if EUR/USD approaches a key support zone and forms a bullish engulfing candle after a long downtrend, it often signals that buyers are stepping in. That single candle, backed by context, can reveal more than any indicator ever could.

What makes price action trading so effective for EUR/USD is its liquidity and clean structure. Since EUR/USD is one of the most traded pairs in the world, it tends to respect technical levels quite well. You’ll often see clear bounces off support and resistance zones, smooth trends, and consistent reactions to economic news.

To trade it like a pro, you don’t just memorize patterns – you understand why they form. Why did price reject this zone? Was it because traders took profit, or because new buyers entered the market? That kind of curiosity is what separates skilled price action traders from those who simply copy chart patterns.

Moving Average Crossover Strategy

The moving average crossover strategy is like a compass for trend-followers. It simplifies trading decisions by signaling when the momentum shifts between buyers and sellers. The idea is straightforward: use two moving averages — one short-term (like the 9-period EMA) and one longer-term (like the 21-period EMA).

When the short-term average crosses above the longer one, it indicates that the short-term momentum is stronger — a potential buy signal. Conversely, when it crosses below, it may hint that sellers are taking over.

Now, this strategy works particularly well on EUR/USD during strong trends. The key is to avoid sideways markets, where the crossovers can be misleading. One way professionals filter such false signals is by confirming direction using higher timeframes or checking for strong momentum candles.

Some traders also blend this approach with fundamentals. For instance, if the European Central Bank hints at tightening monetary policy and the crossover points upward, that alignment between technicals and fundamentals adds weight to the setup.

In trading, clarity often beats complexity — and moving averages, when used wisely, offer that clarity.

RSI and Momentum-Based EUR/USD Trades

The Relative Strength Index (RSI) isn’t just an indicator — it’s a window into market psychology. It helps you understand when traders might be overreacting. When RSI dips below 30, it suggests the pair is oversold; above 70 means it could be overbought.

But professional EUR/USD traders rarely act on RSI alone. Instead, they read it in context. For example, during a strong uptrend, RSI can stay overbought for days — and selling just because it hits 70 can mean missing the entire rally.

A smarter approach is to look for momentum divergence — when price makes a new high, but RSI doesn’t. That subtle clue often signals a potential slowdown in buying pressure. Combine this with key levels on the chart, and you’ve got a powerful way to catch reversals early.

Momentum-based trading in EUR/USD works best when tied to volatility shifts — after news events, during London open, or right before major data releases. Those are the moments when price tends to move sharply, and RSI helps gauge whether that move is sustainable or stretched.

Breakout Trading for EUR/USD

Breakouts are exciting — they’re the moments when the market finally commits after hours or days of hesitation. In EUR/USD, breakouts often happen around major technical levels or after economic announcements that shift sentiment.

Imagine price consolidating between 1.0850 and 1.0900 for days. When it finally breaks and closes above that upper level with strong volume, traders see that as a cue to ride the momentum. However, not every breakout is real. Many times, EUR/USD will “fake out” — breaking a level just to reverse and trap traders.

To avoid such traps, professionals wait for confirmation: a retest of the broken level or a strong candle closing beyond it. Volume, session timing, and fundamentals also help confirm the strength of a breakout.

Breakout trading thrives when volatility is high — like during the New York session overlap. That’s when liquidity surges and breakouts have real conviction behind them.

Support and Resistance Strategy

Support and resistance form the backbone of almost every trading strategy. These are zones where price repeatedly reacts, suggesting strong buyer or seller interest. In EUR/USD, these zones are often beautifully respected because of the pair’s massive liquidity.

When EUR/USD approaches a strong support, traders watch for signs of exhaustion in selling — maybe a long lower wick, a double bottom, or slowing momentum. At resistance, it’s the opposite: short wicks, rejection candles, and bearish formations signal potential reversals.

The secret is to treat these levels as zones, not exact lines. Price often overshoots by a few pips before turning. Many traders get stopped out because they expect a perfect bounce — but real markets are rarely that clean.

Combine these levels with fundamentals (say, an ECB press conference aligning with a resistance test), and your accuracy improves drastically.

Mean Reversion Strategy

While trend followers ride momentum, mean reversion traders look for extremes. This approach assumes that price, no matter how far it strays, eventually returns to its “mean” or fair value.

For EUR/USD, mean reversion setups often appear after sharp, emotional moves — say, when a surprise inflation report causes a 100-pip spike. Once the dust settles, price tends to cool off and drift back toward equilibrium.

Indicators like Bollinger Bands or the RSI help identify such overextended conditions. But more importantly, timing matters — you don’t want to fight strong momentum too early.

Professionals often combine mean reversion logic with fundamentals. For instance, if a short-term panic move contradicts the broader economic trend, that’s often a high-probability reversion setup.

How to Manage Risk in EUR/USD Trading

If there’s one thing every professional trader agrees on, it’s this: your risk management will decide your longevity in the market. You can have the best strategy in the world, but without proper risk control, you’re one bad day away from blowing up your account.

Managing risk in EUR/USD trading starts with position sizing. Never risk more than a small percentage of your capital — most pros stick to 1% or 2% per trade. That way, even a series of losses won’t knock you out emotionally or financially.

Also, consider volatility. The EUR/USD behaves differently across sessions. A trade during the London-New York overlap might need a wider stop than one in the Asian session. Adjusting for volatility ensures your stops aren’t too tight or too loose.

Lastly, diversification helps — not by trading multiple pairs randomly, but by not overexposing yourself to one theme. For example, if you’re long EUR/USD and also long GBP/USD, you’re essentially doubling your USD exposure.

Smart traders protect their downside before chasing upside.

Setting Stop-Loss and Take-Profit Orders

If there’s one lesson every trader learns — often the hard way — it’s that hope is not a strategy. You can’t hope that EUR/USD will turn around when it’s already moving against you. That’s where stop-loss and take-profit orders come in — they’re your seatbelt and parachute rolled into one.

A stop-loss is your way of saying, “I’ll take this small loss now so I can stay in the game tomorrow.” It’s not just about avoiding disaster; it’s about protecting your mental clarity. Without one, every trade becomes a guessing game, and emotional decision-making takes over.

The take-profit, on the other hand, helps you lock in gains before greed tempts you to hold too long. Think of it as a disciplined way of saying, “Enough for now.” It prevents you from turning winning trades into losers — something even seasoned traders struggle with.

When setting these levels in EUR/USD, you need to consider volatility and structure. If you place your stop-loss too close, normal price fluctuations will stop you out. Too far, and you risk more than necessary. A good rule of thumb: place stops beyond key support or resistance levels — areas where the market would have to decisively change direction to invalidate your trade.

For take-profits, don’t rely on random numbers like “I’ll take 50 pips.” Instead, aim for logical targets — maybe the next resistance zone, a Fibonacci level, or a round psychological figure like 1.1000.

And here’s something many traders overlook: your stop-loss and take-profit levels must reflect your risk-to-reward ratio. Ideally, you want setups where you can make at least twice as much as you risk. If you’re risking 30 pips, aim for 60 or more in profit. That way, even if half your trades lose, you’ll still come out ahead.

The Psychology of EUR/USD Trading

If charts were the only thing that mattered, everyone would be rich. But trading is 80% psychology. The EUR/USD market tests not just your analysis but your patience, discipline, and emotional balance.

You can have a perfect setup, a great entry, and still lose money if you panic too soon or move your stop out of fear. The truth is, most traders don’t lose because they’re wrong — they lose because they can’t sit still when the market moves.

Trading EUR/USD day after day is a mental game. You’ll have moments of doubt when your strategy hits a drawdown or when news suddenly reverses your position. In those moments, discipline matters more than skill. Professionals learn to detach emotionally from outcomes — they trust their process.

A good exercise is journaling. After each trade, note how you felt — anxious, overconfident, frustrated. Over time, patterns emerge. Maybe you overtrade when you’re bored or size up too much after a win. Recognizing these emotional cues can transform how you trade.

Remember: in trading, mastering yourself is more important than mastering the market.

How to Build a EUR/USD Trading Plan

A trading plan is your roadmap – a personal guide that keeps emotions out and consistency in. It defines how, when, and why you’ll take trades.

To start, outline your goals. Are you trading EUR/USD to build steady income, or are you testing your strategy part-time? Clarity here shapes your risk tolerance and trading style.

Next, define your strategy framework. Will you focus on price action, breakouts, or momentum trades? Your plan should include the specific setups you’ll look for, what confirms them, and how you’ll manage trades after entry.

Include your risk parameters — maximum loss per trade, maximum drawdown per week, and how you’ll adjust position size. This prevents you from trading emotionally during tough periods.

Finally, plan your review routine. Once a week, analyze your performance:

- Were you disciplined?

- Did you stick to your strategy?

- What needs tweaking?

A written plan isn’t just for structure — it’s for accountability. When you trade with a plan, you trade with purpose.

Using News Releases to Trade EUR/USD

The EUR/USD pair lives and breathes economic news. A single data release can move it hundreds of pips in minutes. For traders, that volatility can be both an opportunity and a trap.

Key releases to watch include:

- Non-Farm Payrolls (NFP)

ECB and Federal Reserve announcements

Inflation and GDP reports

Interest rate decisions

Before news drops, liquidity thins — spreads widen, and price can whip in both directions. That’s why many traders avoid entering right before a release. But for those who trade the news, preparation is everything.

You can trade pre-news sentiment, where you position yourself based on expected outcomes. Or you can trade post-news reactions, waiting for volatility to settle before entering.

For instance, if the Fed signals a dovish stance (hinting at rate cuts), USD might weaken, pushing EUR/USD higher. But always confirm with the chart — news creates direction, but price action confirms conviction.

Remember: don’t let headlines trade for you. Read the reaction, not just the report.

How Inflation Affects EUR/USD

Inflation is one of the most powerful forces driving currency values. When inflation rises, central banks respond — and those responses move the market.

If eurozone inflation climbs, the European Central Bank (ECB) might raise rates to cool spending. Higher rates often strengthen the euro because they attract foreign capital seeking better returns. On the flip side, if U.S. inflation surges faster than Europe’s, the Federal Reserve may act more aggressively, boosting the dollar and pushing EUR/USD lower.

Traders who understand this dynamic can anticipate major moves. For example, between 2022–2023, inflation-driven rate hikes caused significant EUR/USD volatility. Those who followed the policy tone from both sides — not just the numbers — often caught early signals of trend reversals.

Inflation isn’t just a macro concept — it shapes every candle you see on the chart.

Trading EUR/USD During Economic Crises

During crises, everything changes — liquidity, volatility, even trader psychology. The EUR/USD pair becomes especially sensitive because it reflects global confidence in two major economies.

In uncertain times (like the 2008 financial crisis or the 2020 pandemic), risk sentiment rules. Traders often rush to the U.S. dollar for safety, pushing EUR/USD down. But as recovery begins, the euro tends to rebound sharply as investors seek higher yields again.

For crisis trading, flexibility is key. Forget rigid rules — focus on capital preservation and reduced exposure. Use smaller positions, wider stops, and stay updated with real-time news.

Also, technical levels may lose reliability during panic-driven markets. Fundamentals and sentiment take over. It’s better to wait for stabilization rather than trying to predict the bottom.

Surviving a crisis as a trader isn’t about making big profits — it’s about staying alive to trade the next trend.

How to Backtest Your EUR/USD Strategy

Before trusting your strategy with real money, you need proof that it works — and that’s what backtesting gives you.

Backtesting involves replaying historical data to see how your rules would’ve performed. Platforms like TradingView make this easy with built-in tools and replay modes.

To do it right:

- Define your rules clearly. Every entry, stop, and target should be mechanical — no guessing.

- Test across market conditions. EUR/USD behaves differently in trends, ranges, and volatile periods.

- Record results. Note win rate, average profit, drawdowns, and risk-to-reward.

But don’t stop there. Once you backtest, run a forward test — apply the strategy live with a demo account to see how it performs in real time.

Backtesting doesn’t guarantee success, but it gives you confidence. When you know your edge works, emotions fade, and discipline grows stronger.