Introduction

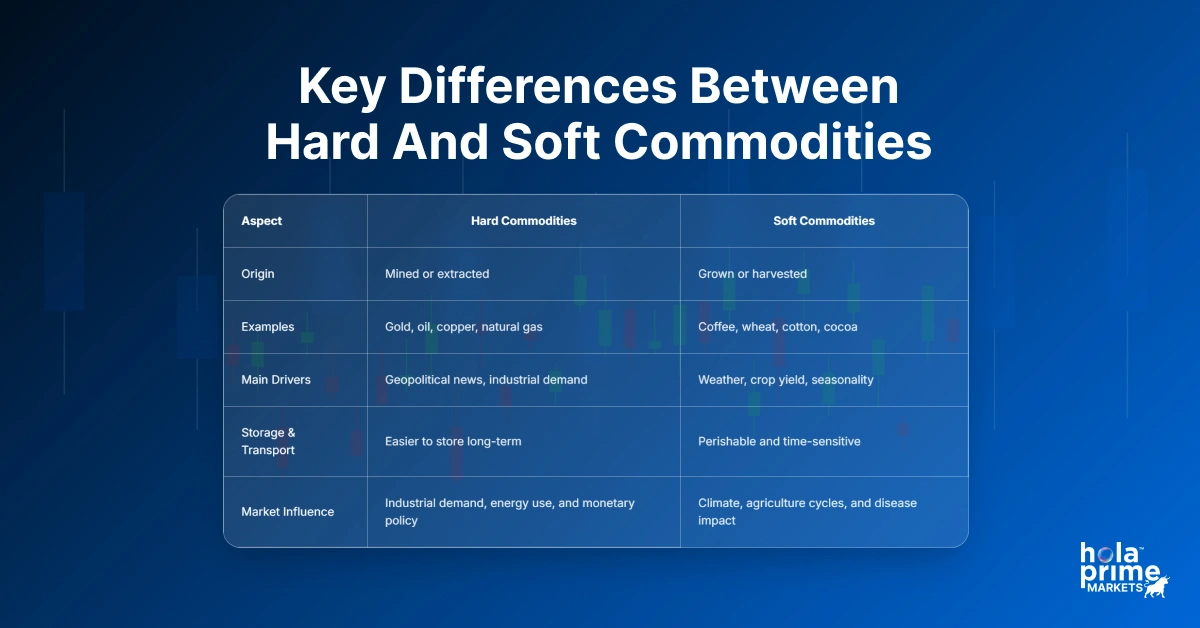

If you’ve spent some time looking at commodity markets, you’ve probably come across the terms hard and soft commodities. It’s one of those simple distinctions that actually says a lot about how different assets behave and why traders approach them differently. At first glance, it looks like just a classification, but once you dive in, you realize it shapes volatility, liquidity, and even trading psychology in a big way.

Starting with Hard Commodities

Hard commodities are the tangible stuff — things we pull out of the ground. Gold, oil, copper, natural gas — they’re all extracted or mined. These are the foundation of modern industries, and that’s exactly why their prices react so sharply to what’s happening in the world.

Let’s say OPEC announces a surprise production cut. You’ll see crude oil jump almost instantly because supply just got tighter. Or take gold. Every time inflation rises or central banks hint at rate cuts, investors rush to it as a hedge. The point is, hard commodities are deeply tied to global events and sentiment. If you enjoy following economic news or big market shifts, you’ll probably find this side of trading fascinating.

Soft Commodities — A Different Game

Soft commodities are quite a different case. Rather than being mined, these commodities are grown. Coffee, cocoa, corn, wheat, and cotton are examples of products that depend on weather, soil, and farming conditions. In these markets, nature matters the most.

Imagine experiencing a dry season in Brazil that negatively impacts coffee plantations. All of a sudden, supply forecasts go down, prices shoot up, and traders have to adjust right away. The same is true for good harvest years when the supply hits the markets and prices collapse faster than predicted. Soft commodities follow a pretty clear seasonal cycle and that’s why they are favorites for traders who enjoy examining cycles and patterns instead of reacting to news flashes.

How Traders Handle Hard Commodities

If you’re trading something like oil or gold, you’re usually watching data, not rainfall. Traders focus on global inventories, central bank statements, and economic data. Oil traders check EIA reports, refinery capacity, or OPEC’s next move. Gold traders, on the other hand, watch inflation reports, bond yields, and currency strength.

There’s often a clear link between macroeconomic factors and market direction, which makes hard commodities a favorite for traders who like fast reactions and global themes.

Trading the Softer Side

Now, trading soft commodities requires patience and a bit of a researcher’s mindset. You’re watching weather updates, crop forecasts, and export data. For example, corn traders care about U.S. planting reports and rainfall in the Midwest. Cocoa traders keep an eye on West African weather patterns.

Soft commodities can turn quickly — a sudden storm or drought can flip the market overnight. That’s why many traders in this space prefer spread strategies, where they balance contracts from different months or regions to manage risk.

Prop Traders and Commodity Choices

Prop traders often split their focus between hard and soft markets. Both offer opportunity, just in different forms. Some prefer hard commodities for the volume and volatility, especially during major events like OPEC meetings or inflation reports. Others like soft commodities for their seasonal predictability and slower buildup of trends.

The best prop traders usually find a balance. They may trade oil during heavy news cycles and switch to coffee or wheat when industrial markets quiet down. Having exposure to both sides can also help smooth out performance — one market’s noise can become another’s opportunity.

Why This Difference Actually Matters

Knowing whether a commodity is hard or soft isn’t just about classification. It changes how you analyze, trade, and even size your positions. Hard commodities demand awareness of macro trends, while soft commodities need an understanding of seasonal cycles and supply logistics.

It’s about matching your trading personality. If you enjoy fast markets and event-driven setups, you’ll likely lean toward hard commodities. If you prefer steady analysis and research-based moves, soft commodities might suit you better.