If you’ve ever watched CNBC or Bloomberg, you’ve heard lines like:

“The S&P 500 closed higher today,” or “The Dow plunged after weak earnings.” They’re not talking about a single company – they’re referring to a stock index, a tool traders use to understand the overall market.

Even if you don’t actively trade stocks, stock indices quietly influence retirement accounts, ETFs, economic outlooks, and investor confidence. They’re like a scoreboard for the market.

But what exactly are stock indices, and why do traders care so much about them? Let’s break it down in a simple, real-world way.

What Are Stock Indices?

A stock index is a basket of selected companies grouped together to represent a portion of the stock market. Instead of tracking thousands of companies, a stock index summarizes how a section of the market is performing using a single number.

Plain English Version:

A stock index is like checking the overall score of a game instead of tracking every player on the field.

Indices give traders a quick way to gauge:

- whether the market is rising or falling,

- how large companies are performing,

- and what the global sentiment looks like.

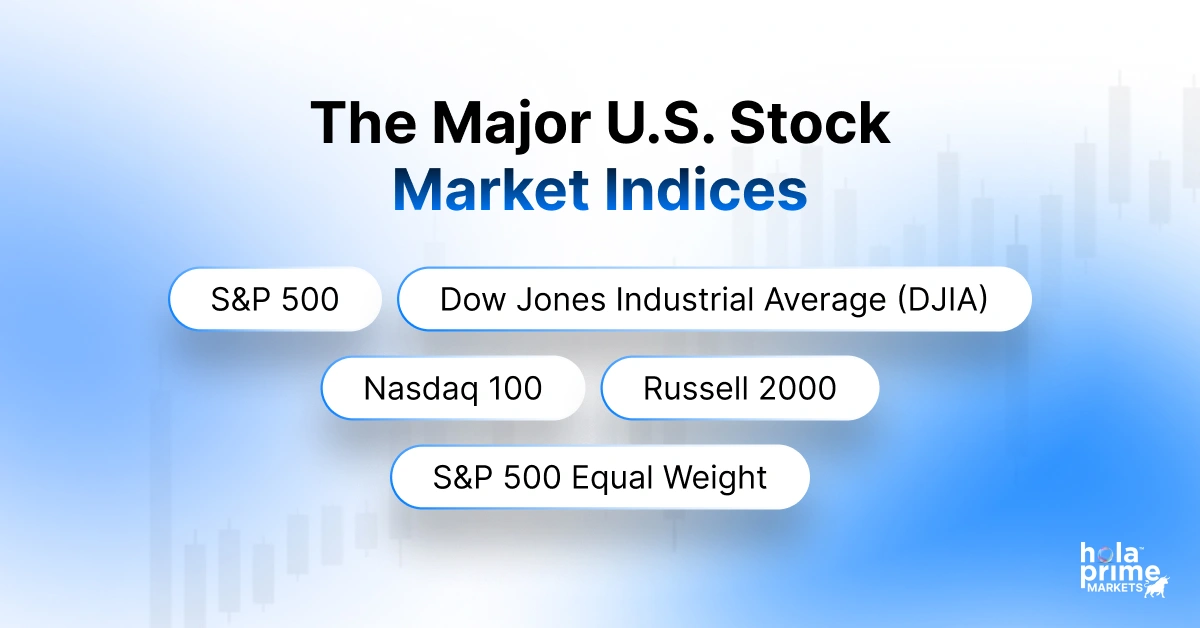

The Major U.S. Stock Market Indices

Here’s a quick look at the most important indices traders watch in the United States:

| Index | What It Tracks | Why It Matters |

| S&P 500 | 500 largest publicly traded U.S. companies | Most accurate gauge of U.S. market health |

| Dow Jones Industrial Average (DJIA) | 30 major blue-chip companies | Shows the performance of established corporate giants |

| Nasdaq 100 | Top non-financial companies listed on Nasdaq (mainly tech) | Highlights tech and growth stocks |

| Russell 2000 | Small-cap U.S. companies | Tracks smaller, fast-growing businesses |

| S&P 500 Equal Weight | Same 500 companies, but weighted equally | Removes the influence of mega-cap giants like Apple or Microsoft |

These indices are typically what traders refer to when they say “the market is up” or “stocks are crashing.”

Why Do Traders Use Stock Indices?

Traders love indices not because they’re glamorous, but because they make decision-making easier and more logical. Here’s why:

1. They Help Read Market Sentiment

Indices act like a market mood meter.

- If the S&P 500 rises, investors are generally optimistic.

- If the Nasdaq 100 drops, traders may be avoiding riskier tech stocks.

Indices show whether the market feels confident or nervous.

2. They Simplify Analysis

Instead of studying hundreds of charts, traders analyze index direction first. If the index is trending down, individual stocks are more likely to follow. It saves time and prevents trading against the market.

3. They Reduce Stock-Specific Risk

Buying a single stock exposes you to earnings reports, lawsuits, leadership changes, or scandals. But an index spreads risk across many companies. If one company struggles, the others balance it out.

4. They Can Be Traded Without Owning Individual Stocks

You don’t need to own Apple, Microsoft, Amazon, or Tesla individually. Traders can buy or sell indices through:

- Futures (e-mini, micro contracts)

- Options

- ETFs (like SPY, QQQ, DIA)

- CFDs (outside the U.S.)

- Index funds

This makes it possible to trade broad market movements efficiently.

5. They Help Build Better Trading Strategies

Traders use index direction to plan stock trades. For example:

- If S&P 500 trends upward, traders favor long setups.

- If Nasdaq 100 breaks down, traders may short tech-related assets.

Indices act as a roadmap before selecting individual stocks.

How Stocks and Indices Are Connected

Think of individual stocks as “team players” and the index as the “team score.” If Apple, Amazon, Nvidia, and Microsoft all rally, the S&P 500 and Nasdaq 100 will likely push higher. If they tank, the index will fall.

And since big companies carry heavy weight in indices, their movement influences the whole market.

Simple Example:

- If Microsoft or Apple jumps, the Nasdaq 100 will likely rise.

- If major Dow companies slump, the DJIA can pull the market lower.

Knowing the relationship helps traders avoid fighting the trend.

Why Indices Are Especially Important for U.S. Traders

U.S. markets set the tone globally. When American indices move sharply:

- European and Asian markets react

- Commodity prices shift

- Bond yields adjust

- Dollar strength changes

Understanding U.S. indices isn’t just useful for American traders – global markets respond to them.

Final Takeaway: Indices Are the Market’s Language

Learning what stock indices are is like learning the alphabet of the market. Once you understand them, everything else becomes easier:

- reading the news

- spotting market trends

- picking the right stocks

- using futures, ETFs, or options

- managing risk like a professional

Indices simplify the complexity of the market. They don’t predict the future perfectly, but they give traders a reliable compass.

And in trading, following the market’s direction is half the battle.

At Hola Prime Markets you can trade all major indices with 1 hour withdrawals, ultra thin spreads, and zero commission account.